Looking for a cryptocurrency ETF list? You’re in the right place. This article shows you the best cryptocurrency ETFs to invest in. These ETFs make it easy to get into the crypto market without having to manage digital currencies yourself.

Quick Summary

- Cryptocurrency ETFs are a simple and regulated way into the crypto market, providing diversification and risk mitigation of direct cryptocurrency ownership.

- Spot Bitcoin ETFs like Fidelity and VanEck offer direct exposure to Bitcoin by holding the actual asset, providing liquidity and mainstream acceptance while reducing storage risks.

- Investing in cryptocurrency ETFs comes with risks like market volatility, regulatory changes, and reliance on 3rd party custodians, so thorough due diligence and robust risk management are required.

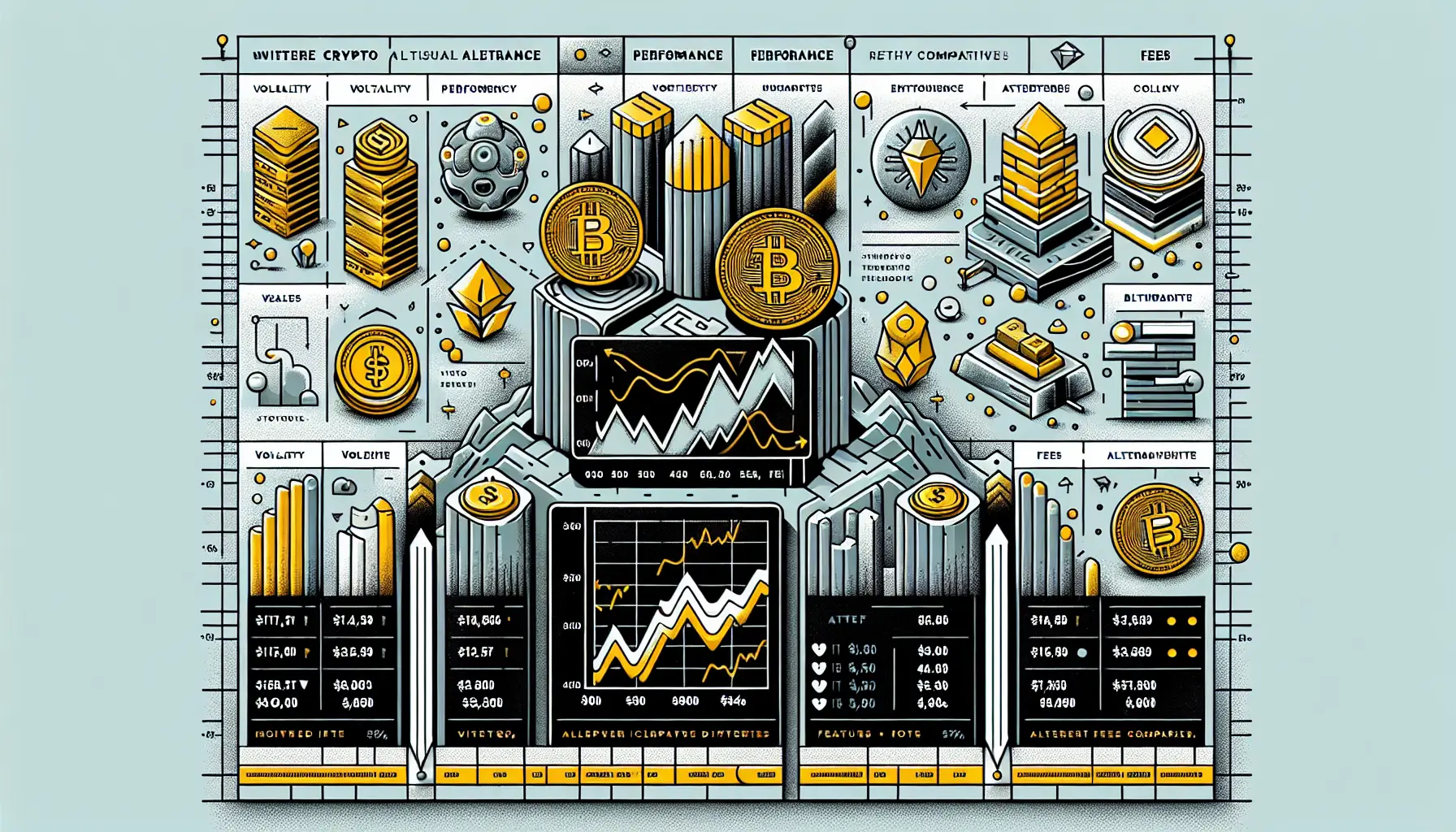

We compiled a table of the best cryptocurrency ETFs for smart investors in 2024. This table includes key details such as assets under management (AUM), expense ratios, and investment strategies.

| ETF Name | AUM | Expense Ratio | Investment Strategy | Notable Holdings |

|---|---|---|---|---|

| Grayscale Bitcoin Investment Trust (GBTC) | $24.47 billion | 1.5% | Direct investment in Bitcoin | Bitcoin |

| Bitwise 10 Crypto Index Fund (BITW) | $697 million | 2.5% | Top 10 cryptocurrencies by market cap | Bitcoin, Ethereum, Cardano |

| Fidelity Bitcoin ETF (FBTC) | $20 million | 0.25% | Direct investment in Bitcoin | Bitcoin |

| Grayscale Digital Large Cap Fund (GDLC) | $224.365 million | 2.5% | Large-cap digital assets, including Bitcoin and Ethereum | Bitcoin, Ethereum, Solana, Polygon |

| VanEck Digital Transformation ETF (DAPP) | $88.1 million | 0.50% | Companies involved in the digital assets economy | Coinbase Global, Marathon Digital |

| Fidelity Crypto Industry & Digital Payments ETF (FDIG) | $78.8 million | 0.39% | Businesses engaged in cryptocurrency, blockchain technology, and digital payments | Coinbase Global, Marathon Digital |

| First Trust Indxx Innovative Transaction & Process ETF (LEGR) | $102.7 million | 0.65% | Companies leveraging blockchain technology | NVIDIA Corp, Amazon, Microsoft |

| Global X Blockchain ETF | N/A | N/A | Businesses related to blockchain technology, including tech and Bitcoin mining | Riot Blockchain, Coinbase Global |

What are Cryptocurrency ETFs

Cryptocurrency ETFs are a lifeline in the choppy waters of digital currencies. By allowing you to invest in multiple crypto assets without the hassle of digital wallets, these exchange-traded funds have made the crypto market accessible to those who prefer the traditional stock exchange experience. Whether you’re looking at bitcoin ETFs or a crypto ETF that dips into a pool of virtual currencies, these funds track the price of digital assets or invest in companies that use blockchain technology, providing a diversified portfolio in the digital financial space.

Plus, cryptocurrency ETFs can fit into your overall investment strategy by giving you exposure to the crypto market while keeping your overall portfolio balanced.

The appeal of cryptocurrency ETFs is in their simplicity and diversification. Investors are attracted to:

- reducing the risks of direct cryptocurrency ownership

- still getting the market upside

- being governed by regulatory bodies that protect investors, adding an extra layer of safety to the Wild West of digital currencies

This balance of innovation and regulation is what makes cryptocurrency ETFs a great option for those wanting to get into digital assets.

Top Spot Bitcoin ETFs

For those who want to get the closest to Bitcoin’s price action, spot Bitcoin ETFs are the way to go. These funds offer:

- They hold actual Bitcoin, giving you direct market exposure.

- They are confident in eliminating the risks of cryptocurrency storage.

- They are liquid. While they don’t guarantee returns identical to Bitcoin itself, spot Bitcoin ETFs are a key step toward the mainstream adoption of digital currencies.

Take, for example, the Fidelity Wise Origin Bitcoin Fund (FBTC) and the VanEck Bitcoin Trust (HODL), with their competitive fees and promotional offers that lower the barrier to entry until certain asset thresholds are met. There are many options for spot bitcoin ETFs, but the Bitwise Bitcoin ETF (BITB) has a 0.20% fee, a sign of the growing competition in the space. These funds not only reflect the pioneer spirit of the first spot bitcoin ETFs but also the maturing market that wants to cater to different types of investors and risk profiles.

The market capitalization of these spot Bitcoin ETFs is a sign of their growing importance in the financial market.

Bitcoin Strategy ETFs

Investing in Bitcoin Strategy ETFs as an investment vehicle is another way to get indirect exposure to Bitcoin’s upside. These funds invest in Bitcoin futures or stocks of companies that mine Bitcoin, so they don’t always follow Bitcoin’s price action. So, they’re an interesting option for those who want to get in on the crypto market growth without owning the underlying digital currency.

The ProShares Ultra Bitcoin ETF (BITU) and the Bitwise Bitcoin Strategy Optimum Roll ETF (BITC) are an example of this. BITC’s fee is 0.85% for a limited time to get more investors in. The Global X Blockchain & Bitcoin Strategy ETF (BITS) has an expense ratio of 0.65%, a sign of the competition in the strategy ETF space. These funds are not only first to market but also show the innovation and flexibility needed to succeed in the world of cryptocurrency investments.

Blockchain ETFs

Beyond Bitcoin and its brethren are the blockchain ETFs, investing in the companies at the forefront of blockchain innovation. These funds give you broader exposure to the applications of distributed ledger technology, from crypto exchanges to smart contracts, and are not tied to the performance of cryptocurrencies. With the blockchain as the backbone of this digital revolution, investing in a blockchain ETF is a way for investors to get in on the growth of a game-changing technology.

Blockchain ETFs are new financial instruments that give you exposure to the technology.

The Amplify Transformational Data Sharing ETF (BLOK) and the VanEck Digital Transformation ETF (DAPP are examples of funds that are positioned in the market. BLOK has a diversified portfolio of blockchain adopters, and DAPP is a global digital transformation. What sets these blockchain ETFs apart is that they look at the broader potential of blockchain technologies, including their application in industries from finance to supply chain management.

Crypto Industry ETFs

Investing in crypto industry ETFs, investors are looking at a basket of companies that are shaping the digital asset landscape. These funds cover a wide range of companies, from those directly involved in cryptocurrencies to those innovating in digital payments and blockchain companies. The Fidelity Crypto Industry and Digital Payments ETF (FDIG) and the Bitwise Crypto Industry Innovators ETF (BITQ) are the big ones managing big assets, a sign of investor confidence and interest in the digital economy.

These ETFs also reflect the current trends in the digital asset space.

The First Trust SkyBridge Crypto Industry and Digital Economy ETF (CRPT) and the VanEck Digital Transformation ETF (DAPP), with their focused investment in the digital economy, give investors a way to get in on the crypto industry growth while keeping a foot in other asset classes. These ETFs are not just investment vehicles but a way to understand how cryptocurrencies and related technologies are becoming part of the global financial system.

Schwab Crypto Thematic ETF and Alternatives

Among the sea of cryptocurrency ETFs the Schwab Crypto Thematic ETF stands out, it focuses on companies that are developing and using cryptocurrencies and other digital assets. With a focus on companies that will benefit from digital currency and blockchain technology, this fund is a forward-thinking investment strategy. Its passive management follows the Schwab crypto thematic index, so investors get exposure to the industry without the need for active trading.

While the Schwab Crypto Thematic ETF is a gateway for investors to get into digital assets, there are many other ETFs to choose from. These alternatives range from diversified exposure to multiple digital currencies to focus on specific parts of the crypto industry, mining, or digital payments. The Schwab Crypto Thematic ETF and its alternatives are in the digital asset market.

Which Cryptocurrency ETF

Choosing the right cryptocurrency ETF requires a compass that is tailored to your individual financial situation, risk tolerance, and investment goals. The right cryptocurrency ETF for you may not be the most popular or the one with the highest returns, but it is the one that aligns with your long-term investment strategy. Choosing the right cryptocurrency ETF can add to your overall investment portfolio. Some things to consider when choosing a cryptocurrency ETF:

- Expense ratios: Lower is better for investors.

- Diversification: Look for ETFs that cover multiple cryptocurrencies to spread the risk.

- Performance history: Research the ETF’s historical performance to see its track record.

- Transparency: Look for ETFs that provide clear and transparent information about their holdings and strategy.

By considering these things you can make an informed decision when choosing a cryptocurrency ETF for you.

Also, the reputation of the ETF issuer can’t be ignored. Established companies with a history of managing ETFs bring valuable expertise and infrastructure to the table to protect your investments in this new and fast-moving market. As crypto ETFs can be more expensive than direct cryptocurrency investments due to additional fees, it’s important to weigh the convenience, cost, and potential returns.

Cryptocurrency ETFs and the Market

Cryptocurrency ETFs have changed the game for the market, making it accessible to investors who would otherwise not touch direct cryptocurrency trading. They have brought more liquidity and capitalization to the market and cemented digital assets in the financial system. Also, the increasing involvement of institutional investors through cryptocurrency ETFs is a sign of the growing acceptance and legitimacy of digital currencies. Cryptocurrency ETFs impact the market by adding liquidity and bringing in institutional investors.

The market has been waiting with bated breath for the US Securities and Exchange Commission to approve a spot bitcoin ETF. If they do, it will be a big deal and could have a big impact on the market. The recent approval of the first-ever spot Bitcoin ETFs has already started to stir the waters and is expected to boost Bitcoin’s price as demand increases.

Risks

Investing in cryptocurrency ETFs is not risk-free. Here are some risks to consider:

- The cryptocurrency market is highly volatile and can cause big price swings.

- Regulatory changes can change the performance and even the existence of these funds.

- The broader crypto markets are unregulated and bring risks even with the regulated framework of cryptocurrency ETFs.

Investors also have to worry about market manipulation and the fact that most spot Bitcoin ETFs use third-party custodians like Coinbase to hold their assets. While custodianship issues are somewhat mitigated since investors don’t directly touch the cryptocurrency, the reliance on fund managers and the fact that you can only trade during market hours can be a consideration for some. These are reasons to do your due diligence and have a solid risk management strategy when investing in cryptocurrency ETFs.

Also, the regulatory environment can impact the performance and existence of cryptocurrency ETFs.

Cryptocurrency ETFs Future

In the future, the cryptocurrency ETF landscape will change with the changing financial markets. Institutional adoption is increasing with hedge funds and pension funds investing, and that will shape the direction of these funds. Also, regulatory developments like those in El Salvador and Singapore will encourage new ETFs to be created and existing ones to expand. The investment landscape for cryptocurrency ETFs will change with institutional adoption and regulatory developments.

As digital assets get integrated into the financial system, more spot Bitcoin ETFs and ETFs on other digital currencies or blockchain-based applications will follow. That will further democratize access to the cryptocurrency market and give investors of all levels sophisticated tools to include digital assets in their portfolios and increase assets under management in this space.

Conclusion

In summary, cryptocurrency ETFs are an innovative and structured way for investors to play the volatile yet potentially rewarding digital asset market. From spot Bitcoin ETFs that give you direct exposure to Bitcoin’s price to strategy ETFs and blockchain ETFs that give you broader exposure to the technology behind cryptocurrencies, there is an ETF for every investment strategy and risk tolerance.

As the world goes digital, the cryptocurrency ETF is proof that traditional investment vehicles can adapt and survive in the digital era. Smart investors now have the tools to join this digital revolution with knowledge and awareness of the risks.

Let your journey to cryptocurrency ETFs be an informed one with clear decisions and forward-thinking.

FAQs

What is a cryptocurrency ETF?

A cryptocurrency ETF is an exchange-traded fund that allows investors to trade shares on stock exchanges without actually owning the digital currency. This gives exposure to cryptocurrencies and related assets.

Are there fees for cryptocurrency ETFs?

Yes, cryptocurrency ETFs have an expense ratio to cover the operational costs. Investors should compare the fees before investing.

Can you trade cryptocurrency ETFs at any time?

No, you can only trade cryptocurrency ETFs during market hours on stock exchanges, not 24/7 like the cryptocurrencies themselves.

Are cryptocurrency ETFs regulated?

Yes, cryptocurrency ETFs are regulated like traditional ETFs to ensure security and oversight for investors.

Do cryptocurrency ETFs have the same risks as owning actual cryptocurrencies?

Yes, cryptocurrency ETFs have the same risks as owning actual cryptocurrencies due to market volatility, regulatory changes, and other risks in the cryptocurrency market. Be careful when investing in this space.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.