Are you looking for an informed Litecoin price prediction? This article presents a grounded forecast for Litecoin’s future, with a no-nonsense approach to its potential value through 2030. Discover key drivers, probable price ranges, and the expert analysis shaping our prediction.

Key Takeaways

- Litecoin is maintaining investor interest and trading activity with significant volatility in its price, which currently fluctuates around $80.88, as it navigates the cryptocurrency market dynamics.

- Experts predict a gradual rise in Litecoin’s value over the next few years, with price estimates varying significantly for 2024 (ranging from a modest $58 to an optimistic $200) and more ambitious projections for 2030 (up to over $14,000), reflecting both optimism and the inherent uncertainty in the market.

- Technical analysis utilizing indicators such as RSI and MACD, along with understanding historical price movements and their causing factors, play crucial roles in guiding investment decisions and predicting future price movements of Litecoin.

Current Litecoin Market Analysis

The current bitcoin price in digital assets paints a picture of significant trading activity and investor interest. At roughly $80.88, Litecoin’s price fluctuates with the market’s rhythm, displaying the vibrancy that keeps traders on the edge of their seats. Yet, recent weeks have witnessed Litecoin’s dance with volatility, dipping to as low as $50 and showing an overall decrease of 18.94%. This fluctuation is not just a number; it’s the pulse of the crypto market, a reflection of sentiment and opportunity.

Peering into the core of Litecoin’s financial stature, we find:

- Price and market cap: with a market capitalization of approximately $6.03 billion, positioning it comfortably within the top echelon of cryptocurrencies

- A circulating supply of 74.44 million coins and a finite cap set at 84 million promise scarcity in a world awash with unlimited fiat currencies

- The 24-hour trading volume of about $551.71 million showcases Litecoin’s liquidity and the confidence traders place in its value.

This is not just a currency; it’s a dynamic participant in the global financial theatre.

As we navigate the ever-shifting tides of the crypto market, Litecoin’s price resilience and the community’s trust in its fundamentals keep it buoyed in a sea of uncertainty.

The market cap and trading volume are more than statistics; they are testaments to Litecoin’s enduring appeal and the foundation upon which future growth is built.

The Future of Litecoin: Price Forecast and Growth Potential

Gazing into the crystal ball of Litecoin’s future, a tapestry of price predictions unfurls, suggesting a gradual yet promising ascent. From the possibility of breaking the $500 barrier to the more conservative estimate of around $200 by 2030, Litecoin’s price forecast is embroidered with threads of growth and potential.

Yet, this future is painted with broad strokes of optimism and caution, as the difficulty in reaching such lofty heights fuels debates among crypto connoisseurs. The question that lingers in the air is not if Litecoin will rise, but rather, by how much and at what pace.

Litecoin Price Prediction for 2024

As the new year unfolds, Litecoin’s trajectory for 2024 appears to be one of moderate uplift. Projections suggest an average trading price orbiting around $84, with the spectrum of litecoin ltc price prediction ranging from a modest $58 to an optimistic $200.

The monthly litecoin price predictions swing between minimum estimates of around $63.71 and maximum forecasts reaching up to $125.98, painting a picture of a currency that, while rooted in reality, is not afraid to go for the stars. Market sentiment towards Litecoin in 2024 is expected to hold steady, with a price increase of 35% by the year’s end, hinting at a year of gradual yet noticeable financial growth.

Expert estimates for the potential highs of Litecoin in 2024 are as diverse as the cryptocurrency market itself, with projections ranging from $117 to an astounding $415. This variation reflects the uncertainty inherent in the crypto world and the boundless possibilities within Litecoin’s grasp. These figures signify a sense of cautious optimism, a belief that while the road ahead may be winding, it is paved with opportunities for significant returns.

The narrative of Litecoin’s price in 2024 thus becomes a tale of two possibilities: a steady climb toward a stable future or a surprising leap fueled by market dynamics and investor confidence.

As with any growth story, the ending is not written in stone but shaped by the collective actions of traders, investors, and the ever-evolving cryptocurrency market landscape.

Moving Towards 2025: Anticipated Trends in Litecoin’s Value

As the calendar pages turn towards 2025, Litecoin’s value is anticipated to tread upward. The projected price range for this year stretches from $283.17 to a notable $424.75, with an average resting comfortably at $353.96.

This significant growth potential signals not only a bright future for Litecoin but also the maturation of a digital asset that continues to capture the imagination of the crypto community. With such forecasts, Litecoin’s narrative shifts from a tale of survival to one of thriving, marking its territory in the digital gold rush of the 21st century.

The anticipated trends in Litecoin’s value for 2025 are not mere speculative numbers; they culminate years of consistent development, community engagement, and technological innovation. This projected upward trend echoes the broader sentiment of a market increasingly recognizing cryptocurrencies’ inherent value as both a means of exchange and a store of value.

As investors look to the future, they see Litecoin as a vessel capable of sailing through the turbulent market waters with grace and strength. The journey towards 2025 is not without its challenges, yet Litecoin appears poised to meet them head-on, buoyed by a community that believes in its potential.

This period in Litecoin’s history may be marked as a defining era when the currency transcends its role as a mere alternative to Bitcoin and asserts its identity as a digital asset worthy of investment and trust.

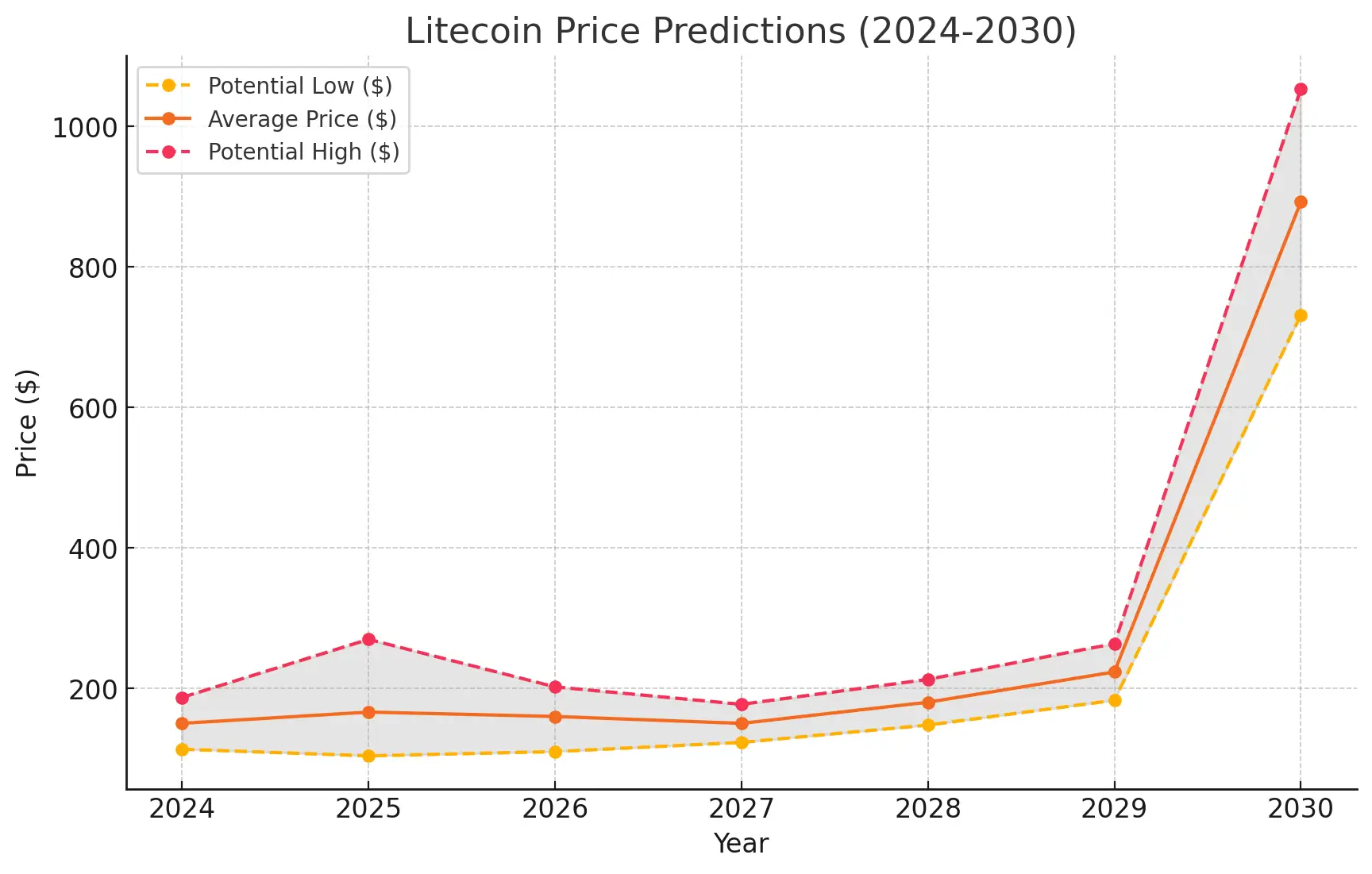

Long-Term Outlook: Litecoin Price Projections for 2026-2030

The long-term outlook for Litecoin stretches beyond the immediate horizon, with price projections painting a picture of varied landscapes. By 2029, analysts anticipate an average trading price of around $656, with potential peak values soaring as high as $927.

When the calendar flips to 2030, the range of predictions widens dramatically, with some forecasts suggesting a staggering valuation between $11,324.71 and over $14,000 and more conservative estimates placing Litecoin at an average price of $478. Such projections are not just figures plucked from thin air; they are the distilled essence of market research, expert analysis, and the ever-evolving story of Litecoin. Keeping an eye on the LTC price today can help investors make informed decisions for the future.

The projected growth of Litecoin, once viewed as a bullish fantasy, is now a topic of significant debate among industry analysts. The consensus seems to point towards stabilization and growth, albeit with the understanding that the path to such heights is fraught with unknowns.

Political risks, news developments, and updates to its blockchain technology all have roles to play in shaping Litecoin’s long-term price trajectory up to 2030. Yet, amidst the sea of predictions, one litecoin forecast stands out for its caution: Coin Price Forecast predicts a rise to about $117 by summer 2030, inching up to $124 by year-end.

These long-term projections for Litecoin are not just numbers on a chart but narratives woven into the fabric of the cryptocurrency’s existence. They serve as a compass for investors and enthusiasts alike, guiding decisions and sparking conversations about the future of digital currencies.

As the tale of Litecoin unfolds over the coming decade, the only certainty is that its journey will be one to watch, filled with twists and turns, peaks and valleys, and the promise of uncharted territories yet to be explored.

Technical Analysis: Indicators and Patterns Shaping Litecoin’s Price Action

In the intricate dance of the markets, technical analysis is the choreography that guides Litecoin’s price action. Tools like moving averages (MA) and oscillators such as the MACD (Moving Average Convergence Divergence) help traders navigate the ebb and flow of Litecoin’s value over time.

The current Relative Strength Index (RSI) value of 41.75 for Litecoin suggests a neutral market position, neither overbought nor oversold, offering a balanced stage for potential moves. These indicators are not merely lines on a graph; they are the heartbeats of market sentiment, the whispers of trend reversals, and the drumbeats of continuity.

RSI and MACD are essential for traders to make informed decisions, providing a lens through which to view the momentum of Litecoin’s price movements. They act as the currency’s pulse, signaling when to enter or exit trades and offering a glimpse into the future through the patterns of the past.

As traders and investors look to these technical indicators, they find data and a narrative of possibility, a story of what might be woven through the candlesticks and lines of Litecoin’s price chart.

Technical analysis is a beacon of systematic study in cryptocurrency, where volatility is the norm and certainty a luxury. It is a discipline that demands respect and rewards those who heed its call. For Litecoin, these technical indicators and patterns are the threads that weave together the story of its price action, a tapestry rich with the potential for profit and the wisdom of markets past.

Understanding Litecoin’s Historical Price Movements

The journey of Litecoin’s price is storied, punctuated by peaks and recoveries that tell tales of market sentiment and technological milestones. Historical highs, such as the $250 mark reached in 2017 and the $410 zenith in 2021, are not just numbers but chapters in Litecoin’s evolving narrative. These peaks were influenced by factors such as:

- halving events, which historically led to increased trading volumes and price surges, followed by periods of miner disinterest and subsequent drops

- overall market sentiment

- the founder Charlie Lee’s token sale in 2018

- the influx of capital into the crypto industry in mid-2021

The story of Litecoin’s value is also colored by external events, such as the overall market sentiment, the founder Charlie Lee’s token sale in 2018, and the influx of capital into the crypto industry in mid-2021.

Despite the turbulence, Litecoin has consistently shown an ability to rebound, a testament to its resilience and the faith of its community. This history of price movements is not just a ledger of highs and lows; it is a testament to the currency’s endurance, a record of its ability to adapt and recover. As investors and enthusiasts pore over historical data, they gain insights into the forces that have shaped Litecoin’s trajectory and the potential for future growth.

At its heart, the story of Litecoin’s historical price movements reflects the cryptocurrency market’s maturation. From its early days as a novel concept to its current status as a mainstay in the digital currency space, Litecoin has weathered the storms of market volatility and emerged with a legacy of tenacity and potential. The history of its prices serves as both a roadmap of where it has been and a compass pointing towards where it might go.

Litecoin’s Investment Landscape

The landscape of Litecoin investment is as varied as the terrain of the cryptocurrency market itself. Recognized for its strong technical foundation and active development community, Litecoin’s investment potential is bolstered by its accessibility and significant market capitalization.

Yet, its long-term survival and success hinge on a delicate balance of continued support, business adoption, and the ability to remain competitive in a crowded market.

This investment vista is not just a static view but an ever-shifting panorama reflecting the crypto space’s dynamism and the strategic considerations underpinning successful digital asset investments.

Is Litecoin a Good Investment?

Whether Litecoin is a good investment echoes through the halls of the cryptocurrency world, attracting varied responses influenced by market conditions and adoption rates. Over the past year, Litecoin has seen its value decrease by 11.13%, which speaks to the currency’s volatility and the need for careful consideration when investing.

Market cycles typically lasting 2-3 years add another layer of complexity, further complicating the investment decision. The uncertainty surrounding Litecoin’s long-term profitability is a reminder that investment in digital currencies requires capital, a keen understanding of market dynamics, and the ability to anticipate future trends.

Analysts urge investors to weigh their investment horizon and risk appetite when considering Litecoin as part of their portfolio. The currency’s suitability as an investment varies based on individual factors such as investment timeframe and willingness to take risks.

For those with a taste for speculation and a short-term focus, Litecoin may present an attractive option, albeit one fraught with the potential for high volatility. The investment debate surrounding Litecoin is not a question of black or white; it is a spectrum of grey that demands a nuanced approach and a measured strategy.

Ultimately, whether Litecoin constitutes a good investment is a personal calculation that balances the potential for growth against the risk of loss. It is a decision that must be made with both eyes open, informed by data, guided by analysis, and anchored in the reality of an ever-changing market.

For some, Litecoin represents an opportunity for profit; for others, a risk too great to bear. As with all investments, the answer lies in the intersection of personal goals, market knowledge, and the courage to act.

Litecoin Investment Strategy

Crafting a successful investment strategy for Litecoin involves more than a mere buying decision; it calls for a blueprint that encompasses one’s goals, investment horizon, and risk tolerance. This framework is not just a financial plan; it’s a personal manifesto that dictates how one navigates the volatile seas of the cryptocurrency market.

Whether opting for spot trading with its direct purchase of coins or the leveraged landscape of derivatives trading, each approach demands a distinct set of skills and a clear understanding of market mechanisms. Litecoin’s divisibility further enhances the adaptability of investment strategies, allowing for tailored approaches that match individual financial aspirations and risk profiles.

Moreover, a prudent Litecoin investment strategy extends beyond the charts and into compliance. Keeping abreast of legislative rules and tax legislation is essential to ensure one’s investment journey is profitable and aligns with the law.

This perspective transforms the investment strategy from a mere method of wealth accumulation into a disciplined pursuit of financial growth within the boundaries of regulatory frameworks. It’s about striking a balance between aggressive pursuit and cautious progression, ensuring that one’s investment in Litecoin remains secure and sustainable.

A Litecoin investment strategy is a tapestry woven from individual financial goals, market research, and risk management. It’s an art as much as a science, requiring the boldness to seize opportunities and the wisdom to hold back.

For the savvy investor, Litecoin presents a canvas upon which to paint a diverse portfolio that reflects not only the potential for profit but also the values of responsibility and foresight. Seeking investment advice from professionals can further enhance this strategy.

Factors Influencing Litecoin’s Future Price

Several stars align in the constellation of factors influencing Litecoin’s future price, each contributing its gravitational pull. Some of these factors include:

- Halving events, which historically have ignited price ascents by tightening the reins on Litecoin’s already finite supply

- Government regulations and economic conditions which can sway Litecoin’s value in unforeseen ways

- Technological advancements, such as integrating smart contracts and wallet improvements, can attract new users and investors and potentially elevate Litecoin’s market stature.

These are just a few examples of the many factors that can influence the future price of Litecoin, including minimum and maximum prices.

The finite nature of Litecoin, with a maximum supply of 84 million coins, weaves a narrative of scarcity likely to play a central role in its price determination as demand grows over time. The public’s perception, shaped by news and sentiment, can send ripples across the market, causing immediate and significant price fluctuations.

Moreover, Litecoin’s price trajectory often mirrors that of Bitcoin, the titan of the crypto market, suggesting a symbiotic relationship where Litecoin’s fate is intertwined with the broader shifts in Bitcoin’s price.

Acknowledging these factors is akin to charting a map of the cosmic forces that govern Litecoin’s journey through the market. They are not mere influences but powerful drivers of change, each capable of propelling Litecoin toward new heights or pulling it into the depths.

Investors and enthusiasts must watch these elements, for they hold the keys to understanding Litecoin’s potential and the wisdom to navigate its future price movements.

Expert Opinions on Litecoin’s Price Forecast

A chorus of expert voices harmonizes to offer a spectrum of opinions on Litecoin’s price forecast, each note adding depth to the symphony of predictions. The consensus is optimistic, with industry veterans and cryptocurrency luminaries projecting a bright future with growth for Litecoin.

While the short-term outlook can be as fickle as the winds, the long-term vision for Litecoin’s price is painted in bullish hues, with expectations of increases without the ominous clouds of significant crashes.

By the year 2030, visions for Litecoin’s price range from:

- The conservative estimate is $164.82, and the loftier goal is $247.22, as suggested by Ambcrypto.

- Potential prices are between $139.89 and $483.89, as forecasted by Coincodex.

- A price range for Litecoin of $880.42 to $1,041.87, as predicted by Changelly’s analysts.

These varied predictions are not mere speculation; they represent the meticulous research conducted by experts at Hotcoinpost, who delve deep into the crypto market to provide the most reliable forecasts.

The weight of these expert opinions cannot be overstated, as they significantly influence market expectations and investor behavior. The wisdom of these voices often guides the hand of the market, shaping the trajectory of Litecoin’s price and the strategies of those who invest in it.

As these experts continue to analyze and predict, they provide a beacon for investors navigating the murky waters of cryptocurrency investment, offering a glimpse into the potential future that awaits Litecoin.

Litecoin Compared: How It Stacks Up Against Other Cryptocurrencies

In the grand arena of cryptocurrencies, Litecoin stands out with its distinctive features that offer a competitive edge. The promise of lower transaction costs and faster processing times positions Litecoin as an appealing alternative to its peers.

Furthermore, its less energy-intensive proof-of-work algorithm sets it apart from the more power-hungry Bitcoin, providing a greener option for the environmentally conscious investor. With transaction confirmations clocking in at an average of two and a half minutes, compared to Bitcoin’s nine, Litecoin showcases efficiency in a market that values speed.

The ingenuity behind Litecoin’s distinct hashing algorithm facilitates faster transactions and lends the currency a unique technical identity. Some key features of Litecoin include:

- Faster transaction times compared to Bitcoin

- Maximum supply limit of 84 million coins, quadruple that of Bitcoin

- A strong reputation as the ‘silver to Bitcoin’s gold.’

While Bitcoin may command a larger market capitalization, indicative of its dominant demand and perceived value, Litecoin holds its own with its unique features and strong reputation.

Comparing Litecoin to its contemporaries is not just about tallying features and shortcomings; it’s about understanding the unique position Litecoin occupies in the cryptocurrency ecosystem. Its creation by a former Google and Coinbase engineer, Charlie Lee, has imbued Litecoin with a legacy of credibility and a vision for what a digital currency can be.

As the ‘silver’ to Bitcoin’s ‘gold,’ Litecoin provides a testament to the diversity and innovation that define the world of cryptocurrencies.

Real-Time Litecoin Price Chart and Analysis

As we observe the real-time tapestry of Litecoin’s price chart, the currency’s recent price of $80.99 reflects a slight dip, with a 1.03% decline over the past 24 hours. This snapshot captures the heartbeat of the market, a living document of Litecoin’s short-term price fluctuations.

With 57% green days recorded in the last 30 days, the chart tells a story of resilience and the currency’s ability to navigate the undulating waves of the crypto market. The real-time price chart is not just a static image; it’s a dynamic portrayal of Litecoin’s ongoing narrative, a narrative that is continually being written by the collective actions of traders and investors around the world.

The analysis of Litecoin’s price chart reveals more than just the ups and downs of its value; it provides a window into the currency’s market presence and the sentiment surrounding it. The fluctuations captured in the chart are echoes of the broader forces at play, from macroeconomic trends to the whisper of rumors within the crypto community.

Through this real-time analysis, investors glean insights, strategists plot their next move, and enthusiasts gauge the pulse of a currency that has become a mainstay in the digital financial landscape.

Overview

As we draw the curtains on our exploration of Litecoin, we are left with a mosaic of insights that together form a comprehensive picture of its place in the cryptocurrency world. From the current market analysis to the long-term price forecasts, from the wisdom of technical indicators to the lessons of history, Litecoin emerges as a currency of resilience, potential, and innovation. The expert opinions and comparative analyses further enrich this picture, offering a multifaceted view of Litecoin’s investment landscape and prospects.

Ultimately, the story of Litecoin continues to unfold, shaped by market forces, technological advancements, and the collective belief of its community. Whether as a diversification tool for the savvy investor or a digital asset of interest for the curious observer, Litecoin holds promise and intrigue.

As we look to the horizon, one thing is certain: Litecoin will remain a currency to watch, a chapter in the ever-growing annals of cryptocurrency history, and a beacon for those seeking to understand the complexities and opportunities of the digital age.

Frequently Asked Questions

What is the projected average trading price for Litecoin in 2024?

The projected average trading price for Litecoin in 2024 is around $84, with estimates ranging between $58 to over $200, offering a broad spectrum of potential outcomes.

How does Litecoin’s price compare to Bitcoin’s?

Litecoin’s price often mirrors Bitcoin’s, but it offers lower transaction costs, faster processing times, and a less energy-intensive proof-of-work algorithm, making it a strong complement to Bitcoin.

Are halving events significant for Litecoin’s price?

Yes, halving events are significant for Litecoin’s price as they historically lead to price increases by impacting supply and stimulating market interest.

What factors influence Litecoin’s future price?

The future price of Litecoin is influenced by factors such as halving events, government regulations, economic conditions, technological advancements, finite supply, public perception, and its relationship with Bitcoin. These elements play a crucial role in determining its value in the market.

Is investing in Litecoin considered a good strategy?

The suitability of investing in Litecoin depends on individual risk appetite and investment horizon, as some consider it a good opportunity for growth, while others find it too volatile. It’s crucial to assess personal investment goals and market conditions before deciding.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.